Houzz: Design and Construction Professionals Forecast Mixed 4Q

Architecture and design professionals report optimism through the end of the year, while more professionals in the construction sector report declines in Q3 business activity than improvements, leading to a somewhat unfavorable outlook for Q4.

The findings were reported in the Q4 2023 Houzz U.S. Renovation Barometer, which tracks residential renovation market expectations, project backlogs and recent activity among businesses in the U.S. construction sector and the architectural and design services sector. Fielded from September 30 through October 12, 2023, the Barometer provides insights into the impact of recent economic volatility on the home improvement market.

“Following improved Q3 business activity, architecture and design professionals are relatively optimistic about business through the end of the year,” said Marine Sargsyan, Houzz staff economist. “However, as business activity continues to slow in the construction sector, build-only professionals in particular have a more negative perspective about the quarter. Despite this outlook, activity continues and backlogs remain at least one week longer than they were last year for the construction sector.”

Backlogs across the construction sector are at 11.4 weeks, up 0.9 weeks compared to the same period last year (10.5 weeks). High wait times of 15.1 weeks are reported by construction professionals in the West North Central region. By contrast, businesses in the architectural and design services sector report significantly shorter wait times (6.1 weeks), a decrease from last year (7.6 weeks).

Q4 2023 Construction Sector Barometer

The overall outlook among firms for the construction sector is unfavorable; however, expectations diverge among design-build firms and build-only remodelers. Design-build firms are more optimistic with an expected business indicator of 53 points, meaning that slightly more businesses anticipate growth than decline. Build-only remodelers anticipate slower activity than the previous quarter (41 in Q4 compared with 54 in Q3).

The Expected Business Activity Indicator related to project inquiries and new committed projects declined to 47 for Q4 (compared with 54 in Q3), which indicates that more businesses expect quarter-over-quarter declines than quarter-over-quarter increases. Expectations for project inquiries decreased to 46, compared with 54 in Q3, and new committed projects are at 47, down 6 points relative to Q3 expectations (53).

The Project Backlog Indicator is 11.4 weeks in the beginning of Q4, which is 0.9 weeks longer than a year ago and 5.1 weeks longer than five years ago in Q4 2018.

The Recent Business Activity Indicator related to project inquiries and new committed projects is at 44 in Q3, up 1 point from Q2. This is driven by a 4-point increase in project inquiries in Q3, relative to the previous quarter and a 3-point decrease in new committed projects to 44 in Q3.

Q4 2023 Architectural and Design Services Sector Barometer

The positive sentiment among the architectural and design services sector is significantly stronger for Q4 (at 61) than the previous quarter (52). More firms expect business activity to improve than those that expect slowdowns. Both interior designers and architects report improved Q3 business activity, though interior designers (64) are somewhat more optimistic than architects (59) that business growth will continue.

The Expected Business Activity Indicator related to project inquiries and new committed projects increased to 61 for Q4 (up 9 points from Q3). The increase in the overall indicator is primarily driven by a 9-point increase in expectations for both project inquiries and new committed projects to 61, each in Q4.

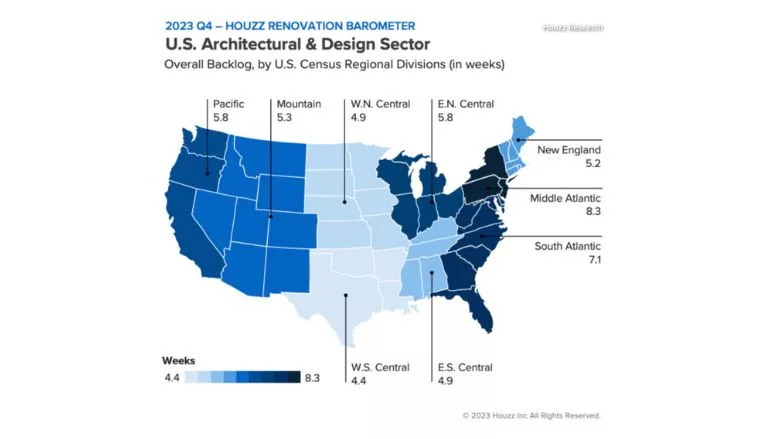

The Project Backlog Indicator is 6.1 weeks in the beginning of Q4. Backlogs are down one-and-a-half weeks compared to last year (7.6 weeks), but a week longer than they were five years ago in Q4 2018 (5.1 weeks).

The Recent Business Activity Indicator related to project inquiries and new committed projects increased significantly to 52 in Q3 (compared with 43 in Q2), with interior designers at 55 versus architects at 51, indicating that more businesses experienced improvements in business activity than those who reported slowdowns for both groups. Following a continuous decline over eight consecutive quarters, the overall indicator is up the second quarter in a row to 52 in Q3. Recent project inquiries increased significantly to 50 and new committed projects increased to 55 in Q3 (up 10 and 9 points, respectively, compared with Q2).

Regional Backlogs

For the construction sector, the West North Central division (including Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota and South Dakota) has the longest backlog (15.1 weeks) driven by wait times reported by build-only and design-build firms in the region (18.3 and 12 weeks, respectively). Businesses in the East South Central division (including Alabama, Kentucky, Mississippi and Tennessee) report backlogs of 5 weeks before they can begin a new project, the shortest wait time reported by construction firms among the nine Census divisions. Compared with the same quarter one year ago, backlogs for the construction sector are longer across five of nine Census divisions (across all but the East North Central, East South Central, Middle Atlantic and the West South Central divisions).

Backlogs also vary across all regional divisions among businesses in the architectural and design services sector. Businesses in the Middle Atlantic division (New York, New Jersey, Pennsylvania, Delaware, Virginia and Maryland, as well as the District of Columbia) reported backlogs of 8.3 weeks, while the West South Central division (including Arkansas, Louisiana, Oklahoma and Texas) showed much shorter backlogs at 4.4 weeks. Backlogs reported by architects in the Middle Atlantic division (10.2 weeks) are the driving force for long wait times, whereas the wait to begin a new project with an interior designer in that area is only 5.1 weeks. Compared with the same quarter one year ago, backlogs for the architectural and design services sector are longer across only two of the nine Census divisions (Middle Atlantic and South Atlantic divisions).

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!

.webp?height=200&t=1729672015&width=200)