Amazon's Next Conquest: How the Tech Giant Could Devour the Flooring Industry

Photo credit: halbergman / E+ / via Getty Images

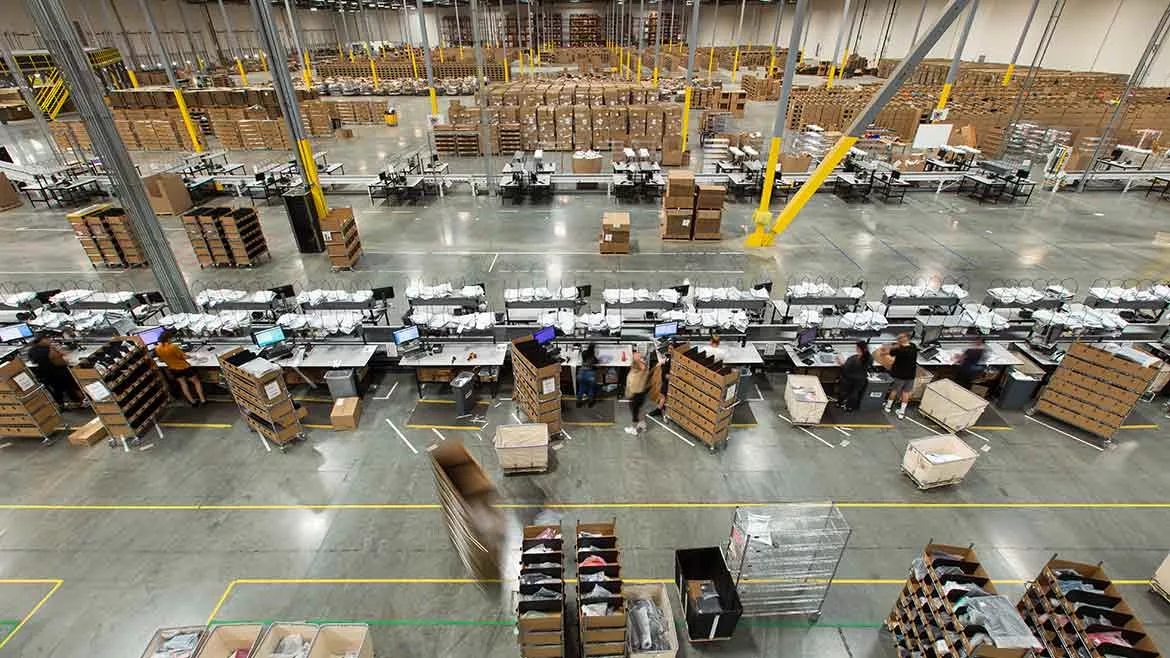

Amazon doesn’t enter industries. It devours them. Books, retail, groceries, cloud computing—if it can be sold, Amazon will find a way to do it faster, cheaper, and with fewer human beings involved. So, let’s talk about an industry that’s been (relatively) safe from Bezos’ algorithmic jaws: flooring distribution. That safety might not last much longer.

Why Flooring? Why Now?

The domestic flooring industry is big—$100 billion+ big (including channel margins and labor). But it’s also archaic. Distribution is fragmented, relationships drive pricing, capital is short, and logistics are complex. In other words, it’s a perfect target for Amazon’s efficiency machine.

If Amazon did buy a super-regional supply chain member, it wouldn’t be just another acquisition. It would be a full-scale supply chain coup. Imagine the world’s most relentless logistics engine fused with an industry that still relies on handshakes and net 60 payment terms.

In an article by Scott Galloway, serial entrepreneur and professor of marketing at New York University’s Stern School of Business, he described how the inferior American Sherman and Pershing tanks were more effective in battle than Germany’s Tiger and Panzer Tanks in WWII. By showing up to the battlefield with 38 more gallons of gasoline than them. Amazon shows up to every fight with 38 gallons. Add in the additional tailwind of an SEC that seems reluctant to enforce anti-monopoly policy thus creating a friendlier regulatory environment for monopoly building. Just saying. Amazon wouldn’t just sell flooring. It would change the rules of the game.

The Valuation Playbook

What’s a big channel partner worth when galactic domination of an industry is your goal? Private sales of flooring wholesalers have historically traded at 6x–8x EBITDA. FND is currently at 23 times EBITDA. If Amazon enters, the multiples go up—not only because the new business becomes more valuable, but because it also becomes a defensive acquisition, protecting their market share against outside threats.

For those unfamiliar, a real-world example of a defensive acquisition is Meta's (formerly Facebook) purchase of Instagram in 2012 and WhatsApp in 2014. Those acquisitions are now being scrutinized as potentially anti-competitive moves aimed at eliminating nascent threats in the social media industry, keeping other players scrambling to keep up. Same thing for flooring if it happens.

As long as we’re imagining, let’s run some numbers:

- If Amazon buys FND, whose 2024 EBITDA was $256M, their acquisition cost, sans various fees, would represent 3-4% of overall industry value.

- Amazon, with its unmatched logistics scale, could push margins from 4.6% (down from 5.6% LY BTW) to 12%+ by cutting waste and slashing SG&A.

- That means Amazon Flooring, under Amazon’s rulebook could generate additional mid-nine figure+ EBITDA, potentially making the deal cash flow positive faster than you can say “Alexa.”

What Amazon Gains

Amazon’s real play isn’t just selling flooring. It’s owning the supply chain and redefining procurement. Here’s what the machine gets:

A foothold in the $500B Home Improvement Market, backstopped by a $14T global construction industry – Flooring is a gateway drug to bigger-ticket home renovations.

What starts with LVT could end with Amazon controlling the entire materials supply chain for builders and contractors.

Business on Steroids

The commercial and residential contractor market is a sleeping giant for Amazon. A flooring distribution network supercharges its ability to establish relationship equity and sell directly to developers, hotels, and property managers.

Manufacturer Leverage – Right now, Mohawk, Shaw, and Tarkett negotiate with dozens of distributors. If Amazon controls a major piece of the channel, it dictates terms.

AI-Driven Inventory & Pricing Dominance – Amazon doesn’t guess demand—it knows it. Flooring manufacturers and retailers still play a game of forecasting roulette. Nate Silver, author of The Signal and The Noise, said that absent empirical data, results are random. Jeff doesn’t do random things. Amazon’s data-driven pricing engine would make competitors look like they’re making decisions with a Magic 8 Ball.

The Fallout: Who Loses?

Regional Distributors: The middlemen will get squeezed—further and harder. Amazon also doesn’t do friendly competition. It does total market capture.

Retailers Who Can’t Adapt: Home Depot and Floor & Decor, for example, will need to counterpunch fast. Their response could be either consolidation, leaning more heavily into their omnichannel strategy, or a pricing war, none of which is fun.

Manufacturers Stuck in the Past: The current oligarchs of flooring may have to choose: play ball with Amazon or risk losing access to the industry’s fastest-growing sales channel.

The Bottom Line

Flooring distribution and retail has been protected by inefficiencies—the complexity of handling logistics-heavy products, Byzantine pricing matrices, and the handshake-driven sales model. But that’s not a moat, it’s an opportunity for disruption. If Amazon steps in, expect ruthless efficiency, better pricing for end-users, and a wave of consolidation. For anyone seeking to cash in and heading for the Seychelles, you should consider surrendering early to this Goliath while your valuation still has a pulse or suffer the fog of war.

Remember, Jeff Bezos once said, “Your margin is my opportunity.”

Flooring? Consider it an opportunity.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!

.webp?t=1690771780)