U.S. Homes Hit Record Age of 36 Years as New Construction Lags

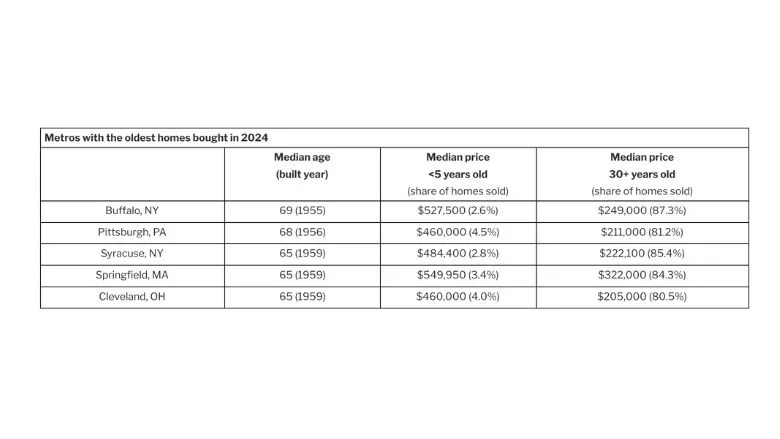

Chart: Redfin.

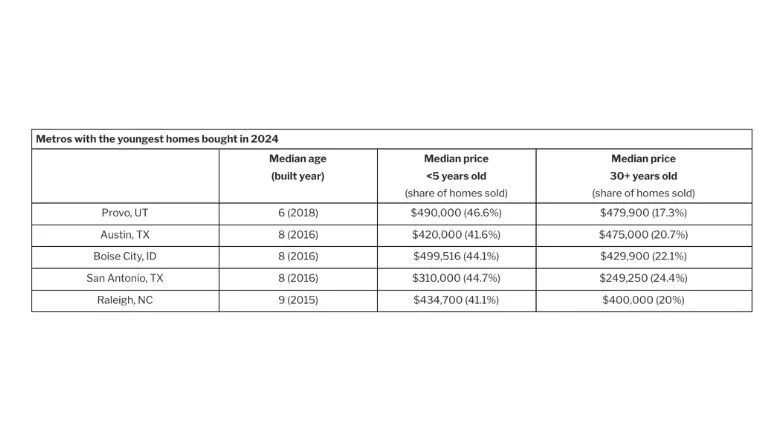

Chart: Redfin.

The median age of homes purchased in the United States hit a record 36 years in 2024, marking a significant shift in the American housing market, according to a new report from Redfin, the technology-powered real estate brokerage.

This represents a nine-year increase from 2012, when the typical home bought was 27 years old, highlighting how a severe shortage of new construction over the past 15 years has accelerated the aging of America's housing inventory.

The analysis of Multiple Listing Service (MLS) data between 2012 and 2024 reveals that homes are aging across all property types, with condominiums showing the most dramatic increase—jumping to a median age of 38 years in 2024 from 26 years in 2012.

"America's housing stock is getting older by the year, and it's not because buyers prefer vintage homes—it's because we haven't built enough new ones," said Sheharyar Bokhari, Redfin Senior Economist. "Without more construction, buyers are forced to choose from a pool of aging properties that present a new set of financial challenges."

The root of the problem traces back to the 2008 financial crisis, which devastated the construction industry. Only 9% of America's homes were built in the 2010s—the lowest share of any decade since the 1940s, when World War II halted construction. While building activity has increased slightly in the 2020s, particularly in Sun Belt and Mountain West states, current projections suggest this decade will see the second-lowest construction rate since the 1940s.

The traditional price advantage of older homes is diminishing. In 2024, newer homes (less than 5 years old) sold for $425,000—31.6% more than the $323,000 paid for homes over 30 years old. This gap has shrunk dramatically from 2012, when newer homes commanded a 77.9% premium.

Similarly, the discount for purchasing older homes has decreased. Buyers paid 15% less than the median home price for properties over 30 years old in 2024, compared to an 18.9% discount in 2012.

Several factors contribute to this narrowing gap: Builders are constructing more affordable home types, with townhouses now comprising nearly 20% of new housing; More construction is occurring in traditionally affordable region; and strong demand in areas with older housing stock is driving up prices.

The report reveals stark geographic differences in housing age. Buffalo, New York, topped the list with homes averaging 69 years old, followed closely by Pittsburgh (68 years), Syracuse, Cleveland, and Springfield, Massachusetts (all 65 years). In these markets, only 2.6% of sold homes in Buffalo were less than five years old.

"Older homes may cost less upfront, but the cost of repairing or replacing big ticket items can be a huge burden for buyers," explained Jerry Quade, a Redfin Premier agent in Cleveland. "We always take a close look at the plumbing and electrical systems, along with the concrete foundations and the roof."

Conversely, Provo, Utah, boasted the youngest housing stock with a median age of just 6 years, followed by Austin, Texas, Boise, Idaho, and San Antonio, Texas (all 8 years). Notably, Austin is one of only four metros where homes over 30 years old actually cost more than newer construction.

"The only four listings I've had this year with multiple offers were older homes," said Andrew Vallejo, a Redfin Premier agent in Austin. "They had all been renovated and were in good proximity to the tech companies, bars and restaurants."

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!