The 2001 State of the Wood Floor Industry Report

The only foreboding statistic, a premature cool down in shipment volume, appeared in the September 2000 report released by NOFMA. And for whatever reason, unfinished red oak hardwood flooring began to once again experience upward pricing pressure. White oak, on the other hand, continued to show signs of stability as most manufacturers resolved to build massive inventories.

The difference between the current pricing environment and that which we experienced less than three years ago is that there continues to be unmistakable signs of a steady, consistent slow down in new home construction. Lumberyards have begun to accrue a large surplus of the various building materials required for construction. So, the recent price hikes seem rather incongruent considering the slackening near-term outlook facing the construction industry.

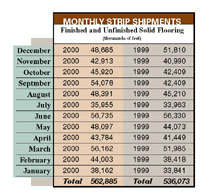

The possibility of a supply shortage became a reality by midsummer 2000. Unfinished hardwood flooring began its cyclical escalation in price. The prefinished hardwood segment, as it has in the past, showed more restraint in terms of pricing increases. Simultaneously, unfinished hardwood shipments began to once again increase.

The reasons for the shortages were unknown to the majority of unfinished hardwood flooring distributors. But it doesn't take a math wizard to realize a softer market that creates potential for stockpiling of product can promote price increases due to the resulting raw material shortages.

In reality, unfinished wood flooring manufacturers had been approached by their internal industry competition -- the prefinished flooring manufacturers. This in itself began to create shortages due of the dramatic influence of deep-pocketed prefinished flooring manufacturers. As a result, the price of unfinished strip products began to escalate. Exacerbating this development was a strategic decision on the part of several unfinished flooring manufacturers to also establish production and a presence in the prefinished market.

If demand for prefinished flooring is indeed on the rise, and consistently steady growth continues, our industry will be ideally positioned in the marketplace as economic forces swing the emphasis from new residential construction to remodel and replacement -- a change that many see on the horizon.

Without question, the volume leader in prefinished flooring products manufacturing continues to be Triangle Pacific. Many observers view the recent bankruptcy filing of Armstrong World Industries, Tri Pac's parent company, as a plus for both investors and Armstrong subsidiaries. The ultimate effects of former Armstrong CEO Floyd Sherman's decision to step down remain to be seen. One thing is for sure, the increasingly aggressive moves on the part of prefinished hardwood floor manufacturers should eventually increase the market share of this product category as a result of market saturation, if nothing else.

I believe 2001 will show continued growth in the hardwood flooring industry. But that growth will flow along a different trajectory than that of previous boom years.

The current uncertain outlook for our economy should be come clearer now that the disputed presidential election is behind us and the stock market has begun to exhibit more stability. With increasing signs of moderate growth, and additional cuts in interest rates, consumer confidence should improve. From the standpoint of our industry, if we are to continue our record of growth, the days of order taking will need to supplanted by a defined marketing strategy that allows us to command our share of the consumer's disposable income.

New residential construction will continue undiminished in the nation's Northeast corridor as well as the West Coast and Pacific Northwest. The Sunbelt states will see building activity decrease ever so slightly to give the industry an opportunity to catch up with the overhang in demand. The Midwest will see the most dramatic slowdown in construction, particularly at the entry and mid-range levels. Upscale housing starts will virtually disappear from the radar screen. Therefore, local market conditions will dictate the ultimate impact on the bottom line of each dealer/contractor.

You really never appreciate anything until you have to fight for it. For us, the floor covering market is the center ring. Wood or Wood Knot will always be in your corner. Just be sure you're at least at ringside before the bell sounds.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!